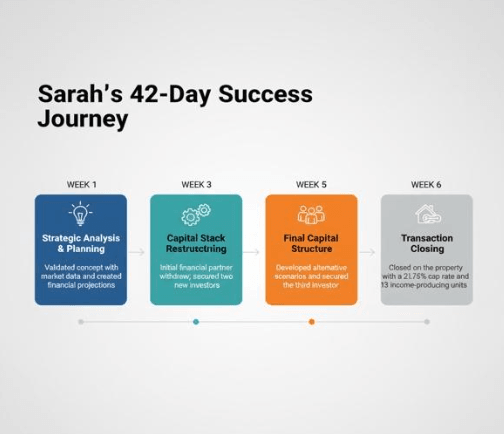

Sarah* found a 3,100+ sq ft property in South Carolina. Traditional use projected ~$2,300/mo for a four-bed single-family rental. After three accelerator sessions and a six-week engagement, she closed the property as a 13-unit branded coliving asset projected to generate $105,544 gross revenue and $73,782 net (NOI), ~$6,148/month cash flow, and an implied cap rate of 21.76%. The transaction overcame two investor exits and closed in 42 days, demonstrating how focused underwriting, brand positioning, and creative capital work together to convert an underused asset into a high-yield product.

*name & sensitive details changed for privacy

The challenge — what Sarah faced and why it mattered

Sarah liked the bones of a 3,100+ sq ft house: good location, strong bones, and a layout that suggested multiple private rooms with common areas. But she had four big uncertainties:

- Market fit: Would the local renter population support a multi-room coliving product priced above typical rentals?

- Financial feasibility: Could converting the house to 13 rooms produce competitive returns once renovation, operations and financing costs were included?

- Capital fragility: She had the property under agreement when two financing partners withdrew — a crisis that could have killed the deal.

- Operational readiness: Even if the numbers worked, did she have an operational plan to run a shared-living product (leasing, community, cleaning, tech)?

Left unchecked, each of these issues can sink a project. Our Accelerator approach was designed to address them in parallel: validate demand, model returns, fix capital, and ready operations fast.

Our approach (what we did — enhanced week-by-week breakdown)

Week 1 — Strategic analysis & concept validation (deep dive)

Goal: Convert Sarah’s intuition into investor-grade certainty.

Why this matters: Early assumptions should be turned into testable inputs. Without a data-backed baseline, you risk overbuilding or underpricing.

Deliverables

- Market sizing and demand segmentation

- Pricing grid and sensitivity ranges

- Concept refinement (audience, brand voice, amenity set)

- Unit mix schematic and room-by-room revenue model

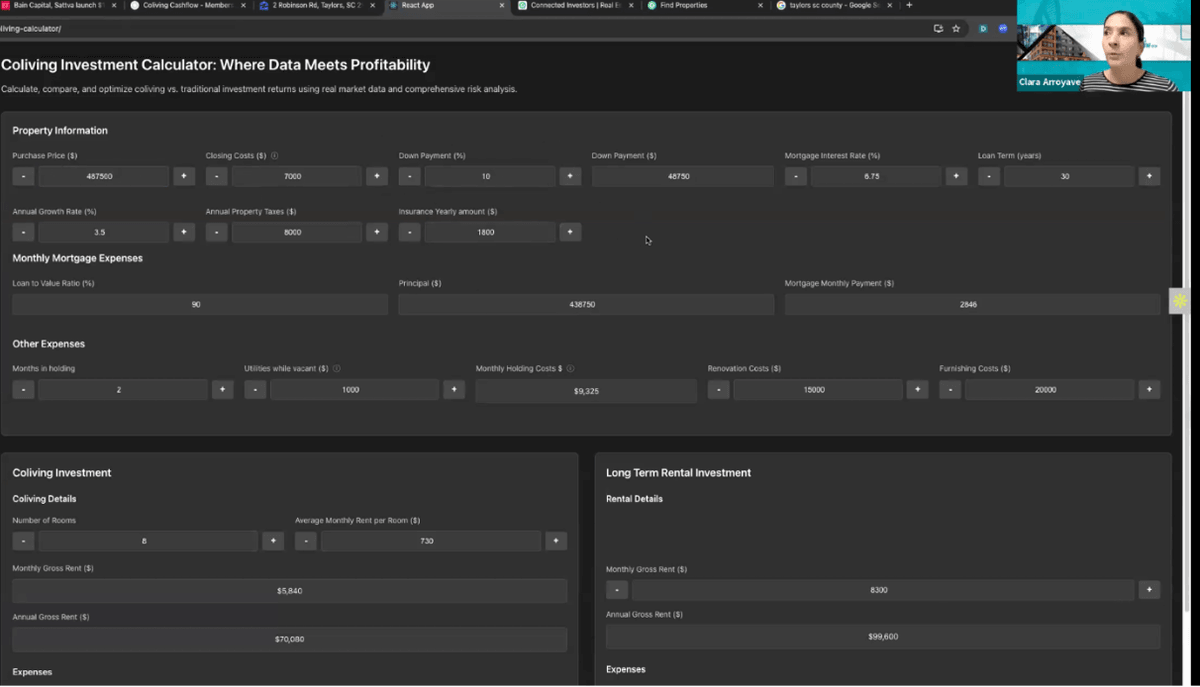

- Base pro-forma using the Coliving Calculator™

Actions we took

- Market sizing: Household count: 215,000+

- Renter share: 31% → ~67,000 potential renters

- Competitive audit: studio rents in the catchment area ≈ $1,100+ / month (used as an anchor)

- Why this matters: you need a sufficiently large addressable market to achieve occupancy and to absorb churn.

- Persona & concept

- Chosen persona: early-career professionals and hobbyists who value entertainment and social life.

Concept: “The Ultimate Man Cave” — a lifestyle product with entertainment-first communal spaces (gaming, pool, AV lounge). - Brand positioning: premium private rooms + professionally curated communal rituals (weekly tournaments, “coach night”, movie premieres).

- Why this matters: a clear persona allows focused marketing and amenity selection and justifies premium rents vs a commodity SFR.

- Unit mix & space planning

- Reconfigured the 3,100+ sq ft into 13 units (two of which are standalone studios) while preserving sufficient common area to maintain a high-quality experience.

- Illustrated trade-offs: adding rooms increases revenue but can erode common space value and resident retention if not done thoughtfully.

- Pricing & pro-forma

- Room pricing set: $950–$1,100 depending on room size and privacy.

- Base assumptions: 90% stabilized occupancy, 6% vacancy/turnover adjustment, operating expense ratio derived from comparable coliving projects.

- Key financials (base case):

- Annual gross: $105,544

- NOI: $73,782

- Monthly cash flow: $6,148

- Implied cap rate: 21.76%

How we validated demand

- Quick ad test: two targeted social campaigns (Facebook + local community groups) to gauge interest, capture leads and validate pricing sensitivity before purchase.

- Partner outreach: approached local employers/universities to explore long-stay agreements.

Week 3 — Capital stack restructuring (first financing setback) — expanded

Problem: initial financial partner withdrew with property under contract — a time-sensitive issue.

Our method

- Rapid diagnostics: reviewed the original stack to identify the gap (equity shortfall vs loan terms).

- Three immediate actions:

- Created a concise investor packet: 1-pager, 10-page model, 5 slide pitch, and a 90-second cap table explainer video.

- Repriced investor returns to make the deal more attractive without changing sponsor economics dramatically (we shifted timing of certain sponsor fees to align with investor preferences).

- Launched a targeted outreach list: local family offices, small value-add RE funds, operator partners (who could bring expertise + capital).

Result: two replacement investors committed in days; we preserved the closing timeline.

Why this worked: Investors liked the visible upside, quick turnaround approach, and the fact that the model emphasized conservative occupancy and revenue assumptions.

Week 5 — Final capital structure (second financing challenge) — expanded

Problem: a third investor was required to close but Sarah had limited extra cash to sweeten the deal.

Our toolkit

- Built three investor scenarios (A/B/C) with different risk/return tradeoffs:

- Scenario A: higher preferred return (6–8% pref) with lower sponsor split on upside

- Scenario B: revenue-share on ancillary income (laundry, vending, event hosting) plus a small management fee kicker

- Scenario C: equity rollover — investor takes lower immediate return in exchange for first-right in future projects

- Created non-cash incentives:

- Brand co-marketing and naming rights for the investor’s network

- Employee housing priority / discount for investor staff

- Early exit preference for anchor investor

Negotiation & close

- Chose a hybrid of Scenario B + minor equity concession. Investor accepted due to upside and operational plan. Closing path cleared.

Key lesson: be flexible on structure: not every investor wants the same thing — some want cash yield, others want capital appreciation or operational involvement.

Week 6 — Transaction closing & immediate execution plan — expanded

Work completed on or immediately after close

- Operations playbook: SOPs for onboarding, cleaning schedule, maintenance, incident escalation, deposit handling, and roommate matchmaking.

- Hiring: contract with a local community manager (PT to start): responsibilities included tours, onboarding dinners, resident communication, and minor maintenance coordination.

- Tech stack: chosen PMS for leases & payments, smart locks for flexible move-ins, and a community app for events and communications.

- Pre-lease campaign: open-house schedule, influencer local partnerships, and targeted ad campaigns to fill the first 60% of rooms before move-in.

Immediate KPIs for first 90 days

- Occupancy target: 60% pre-lease by move-in, 85% by month 3, 90% stabilized by month 6

- Retention target: ≥50% stays over 6 months in first year (benchmarked against similar projects)

- Operational SLA: <24 hours for urgent maintenance, <72 hours for non-urgent

Key financial clarifications & math (detailed transparent)

Formulas used (so readers can reproduce)

- Annual Gross Revenue = Σ (monthly rent_i × 12) for all rooms

- Vacancy allowance = annual gross × vacancy rate (e.g., 10%)

- Operating Expenses = property taxes + insurance + utilities (if owner pays) + cleaning + maintenance + management fees + marketing + reserves

- NOI (Net Operating Income) = Annual Gross − Vacancy − Operating Expenses

- Cap Rate = NOI ÷ Purchase Price

- Implied Purchase Price (from NOI & cap rate) = NOI ÷ Cap Rate

Example calculation from the deal (base case)

- Annual Gross = $105,544

- Assume total operating expenses + vacancy = $31,762 → NOI = $73,782

- Reported cap rate = 21.76% → Implied purchase price ≈ $339,072 (73,782 ÷ 0.2176)

Comparing to SFR baseline

- SFR gross (4-bed): $2,300 × 12 = $27,600

- Coliving gross vs SFR gross: 105,544 ÷ 27,600 ≈ 3.82× (≈ +282% uplift in gross revenue)

- Monthly cashflow uplift: 6,148 − 2,300 = $3,848 extra per month

Note on the “161% increase” citation in the original draft: different bases (gross revenue vs NOI vs monthly cashflow) yield different % changes. We present both gross and cashflow comparisons so readers can see the range.

Operations plan (first 90 days) — detailed SOPs & roles

Staffing

- Community Manager (PT → FT): tenant relations, onboarding, events, lease enforcement. Start as PT (20–30 hrs/week) until occupancy requires FT.

- Cleaning vendor: weekly common area + vacancy cleans; rotation schedule (each room deep-cleaned at turnover).

- Maintenance contractor: retainer for emergency repairs; use local handymen for rapid response.

- Revenue manager (part-time or consultant): manages dynamic pricing and promotions.

SOP examples

- Move-in (48-hour checklist): ID verification, payment confirmation, orientation walkthrough, smart lock setup, house rules signature, community app invite, onboarding dinner within 7 days.

- Housekeeping schedule: common area cleaning every 3 days, kitchen deep clean weekly, bedroom cleaning optional for a paid add-on.

- Incident escalation: resident files via app → community manager triages → maintenance within SLA → escalation to owner if unresolved in 72 hours.

- Conflict resolution: 3-step mediation: (1) informal 1:1 meet; (2) mediation with community manager; (3) formal warning + corrective plan.

Tech stack (recommended minimal)

- PMS: RentRedi / Buildium / AppFolio/ Custom (Everything Coliving) for leases, payments, and basic bookkeeping.

- Access control: smart locks (Aqara, August, Yale) integrated with PMS via API or manual code provisioning.

- Community app: Slack/Discord/WhatsApp for early days; upgrade to a resident app (Homerun, Cohabs-type, Custom - Everything Coliving) at scale.

- Dynamic pricing tool: simple spreadsheet initially; integrate PriceLabs or Wheelhouse for multiple properties.

Marketing & leasing blueprint — detailed tactics

Pre-launch (30–45 days before move-in)

- Landing page: Prominent hero images, concept statement, unit types, FAQ, booking calendar for tours.

- Lead-gen ads: Facebook/Instagram geo + demographic (age 22–40, interests: gaming, tech, nightlife) and roommate platforms.

- Local partnerships: HR contacts at nearby employers, universities, and hospitals; offer corporate rates for block bookings.

- Open houses & experiential events: host “game night” open houses to show the product live.

Conversion funnel

- Lead → Tour → Application → Deposit → Move-in

- Optimize: clear CTAs, instant application response template, automated reminders for deposit & lease signing.

Retention & community

- Onboarding dinner in week 1, weekly events (game tournaments), monthly resident town hall, referral credits (one month discount for referring a roommate who signs 3+ months).

- Monetizable ancillaries: premium linen rental, cleaning packages, private storage, event room rental for external groups.

KPIs to track

- Leads per week, tour-to-application rate, conversion rate (application→signed), average length of stay, referral rate, NPS (resident satisfaction).

Capital/investor story — detailed guidance on materials & messaging

Investor pack essentials

- One-page deal memo: headline returns, unit mix, ARRs, NOI, hold period, exit options.

- 10-page model summary: assumptions, sensitivity table (70/85/95% occupancy), capex schedule, renovation budget, timeline.

- Cap table & waterfall: explain sponsor equity, investor share, preferred return and sponsor promote.

- Visuals: conceptual floor plan, amenity render, 3 sample room photos (stock ok for early stage).

- 3-minute pitch video: concise explanation of concept, team, and why market matters (helps busy LPs).

Messaging points that close

- Conservative assumptions (assume 85% stabilized occupancy in base case).

- Reasonable exit: show resale comparables (cap rate comps) and refinance scenario.

- Operational readiness: present the 90-day ops plan and SOPs to show you can execute.

- Risk mitigation: show contingency reserve and sensitivity (how returns behave at 70% occupancy).

Risks & mitigations (expanded, with examples)

- Regulatory / zoning risk

- Risk: local ordinances or HOA rules restricting number of unrelated occupants or limiting “SRO” conversions.

- Mitigation: early code review, legal counsel, minor reconfiguration options (convert some rooms to studios), secure conditional use permits if necessary.

- Lender appetite

- Risk: banks hesitant to underwrite shared-bedroom models.

- Mitigation: present conservative DSCR, highlight lease structure and operator experience, keep a plan B (bridge lenders, private debt, or higher down payment).

- Market / vacancy risk

- Risk: slower lease-up due to competition or macro slowdown.

- Mitigation: 6–9 month reserves, staged roll-out (open with only some rooms), partner with local employers for guaranteed leases.

- Operational risk

- Risk: poor community management leading to churn and complaints.

- Mitigation: hire experienced community manager, document SOPs, maintain quick maintenance response, run regular satisfaction checks.

- Reputational risk

- Risk: neighbors complaint and local pushback.

- Mitigation: neighborhood outreach, community benefit (local hiring), clear house rules and noise control measures.

Why this deal worked — deeper analysis of success factors

- Robust demand validation: the local renter pool was large enough to support high turnover and yield stable occupancy.

- Iterative modelling: frequent scenario testing allowed Sarah to see downside and upside cases; investors saw a cautious base case and a restorative upside.

- Clear brand & product fit: “The Ultimate Man Cave” spoke directly to a defined demographic — making marketing efficient and lowering acquisition cost.

- Flexible capital packaging: multiple equity scenarios turned a capital gap into an opportunity for creative structuring.

- Execution discipline: simple, prioritized operations and tech selection reduced time-to-stabilization risk.

Actionable takeaways for readers (what you can do tomorrow)

- Run a quick market check: count households and renter % within a 5–10 mile radius. If comp studios are >$900 and renter households >20k you likely have a runway.

- Model 3 occupancy scenarios: 95% (best), 85% (base), 70% (stress) — compare NOI and time-to-breakeven.

- Create a one-page investor memo: include unit mix, ARR, projected NOI, implied cap rate and a 3-point exit thesis.

- Test demand with a $200 ad spend: two Facebook/IG campaign variations (branding vs pricing) to validate conversion cost and pricing tolerance.

- Prepare a capital contingency plan: identify 2–3 potential investor types (family office, operator, private lender) and have a templated offer ready.

Quick checklist — coliving underwriting essentials (expanded)

- Market demand: households, renter %, comps, local employer flows

- Unit mix viability: egress, legal kitchens/bathroom rules, privacy vs amenity balance

- Pro-forma: gross revenue, vacancy, opex, NOI, cap rate sensitivity

- Capital stack: equity, preferred return mechanics, bridge or mezzanine options

- Operations plan: staffing, tech, SOPs, onboarding, cleaning, maintenance vendor agreements

- Legal/regulatory check: SRO rules, occupancy, zoning, local licensing

- Sales & marketing plan: prelease calendar, CRM, open houses

- Exit strategy: market comps, refinance path, potential buyer profiles

Final note & invitation

42 days. 3 sessions. 2 major obstacles. Transaction closed.

Sarah’s case shows how focused coliving expertise — rapid underwriting, brand design, and creative capital structuring — turns unclear potential into a profitable, scalable asset. The difference between hesitation and close was not luck: it was process, tools, and experience.

If you’d like the Coliving Calculator™ sample spreadsheet, the 1-page investor memo template, and a 30-minute strategy audit for one of your active deals, reply to this message or book a call with our Accelerator team. We’ll share the spreadsheet with formulas, a sensitivity table you can paste into Excel, and the fill-in investor memo PDF.

Next steps we can prepare for you (pick one):

- Fillable one-page investor memo (PDF + Word)

3-scenario sensitivity table (Excel) with formulas and breakpoints (70/85/95% occupancy) - 90-day operational checklist (printable) and sample SOPs for onboarding and maintenance

- Pre-lease marketing plan template with ad copy and targeting suggestions